Spread that Qualcomm's inventory chips have significantly reduced prices, with a range of up to 10-20%

The recovery of the mobile phone market is not as expected. The industry has reported that in order to stimulate customers' willingness to purchase and accelerate inventory clearance, Qualcomm has recently launched a price war to lock in mid to low-end 5G mobile phone chips, and the degree of price reduction is "quite impressive", up to 10-20%. It is expected that Qualcomm's price reduction measures will be extended until the fourth quarter, and MediaTek is preparing for the battle.

Industry analysis shows that Qualcomm's large-scale price reduction highlights the dilemma of weak buying in the mid to low end 5G mobile phone market.

It is understood that the consumer electronics market began to be depressed in the fourth quarter of last year, and the downstream inventory level began to decline significantly in the first half of this year, and gradually returned to normal. The market once expected that the mobile phone market in Chinese Mainland would be expected to improve in the second half of this year, and it was reported that Qualcomm would resume some momentum in the second quarter.

Industry analysis shows that Qualcomm's large-scale price reduction highlights the dilemma of weak buying in the mid to low end 5G mobile phone market.

It is understood that the consumer electronics market began to be depressed in the fourth quarter of last year, and the downstream inventory level began to decline significantly in the first half of this year, and gradually returned to normal. The market once expected that the mobile phone market in Chinese Mainland would be expected to improve in the second half of this year, and it was reported that Qualcomm would resume some momentum in the second quarter.

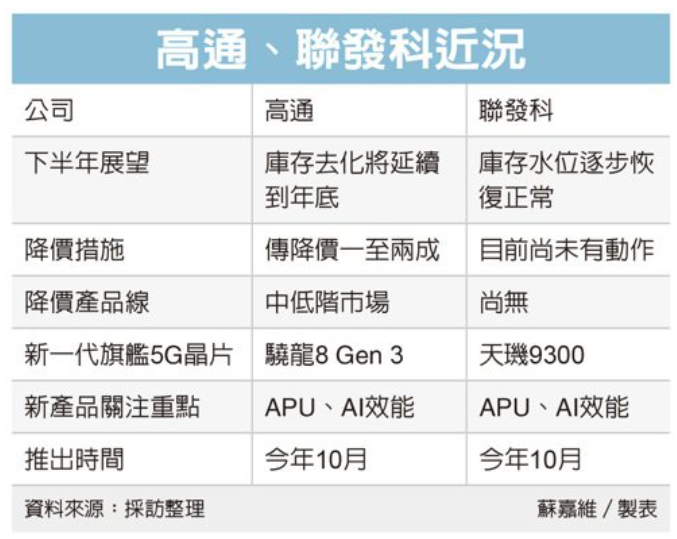

Recent developments of Qualcomm and MediaTek

However, after the 618 Shopping Festival in Chinese Mainland, the downturn in the consumer electronics market has not improved significantly, which has led to the rise of Qualcomm's inventory level to nearly two quarters. With low order visibility and high inventory, it is reported from the supply chain that Qualcomm recently decided to launch a price cutting war, focusing on the middle and low end markets, and the price reduction range is as high as 10% to 20%. It is expected that this wave of price reduction attack may continue to the fourth quarter. If the inventory digestion speed is not as expected, It is not ruled out that another wave of price reductions will be intensified.

The industry points out that Qualcomm has always been in a leading position in the non Apple mid to high end mobile phone market, so this price reduction is focused on the mid to low end sector. It is hoped that by accelerating inventory digestion, it will welcome the launch of the new generation Snapdragon series of mobile phone chips in mid to late October.

It is understood that in the past, Qualcomm would only start a price war after the accumulation of old products for more than a year. This time, unlike in the past, prices began to be significantly reduced less than half a year after the product was launched. The main reason is that in addition to the upcoming new products, another major reason is that the consumer market downturn will continue at least until the end of the year.

As for whether MediaTek will be affected by Qualcomm's price war? The legal representative believes that MediaTek's shipment of mobile phone chips has jumped to the top in the world, and with MediaTek's new chips starting to shift to the mid to high-end market after the second quarter of this year, the impact is expected to be less severe than in the past. In other words, MediaTek still has the opportunity to meet its original financial forecast this quarter, with revenue increasing by 4% to 11%, reaching NT $102.1 billion to NT $108.9 billion.

According to legal analysis, the sluggish trend of the consumer market may continue until the fourth quarter of this year, and there is a chance for a comprehensive improvement next year. The operating performance of MediaTek and Qualcomm this year is almost certain to be significantly lower than last year's historical high level, and it is expected to rebound as soon as 2024.

However, after the 618 Shopping Festival in Chinese Mainland, the downturn in the consumer electronics market has not improved significantly, which has led to the rise of Qualcomm's inventory level to nearly two quarters. With low order visibility and high inventory, it is reported from the supply chain that Qualcomm recently decided to launch a price cutting war, focusing on the middle and low end markets, and the price reduction range is as high as 10% to 20%. It is expected that this wave of price reduction attack may continue to the fourth quarter. If the inventory digestion speed is not as expected, It is not ruled out that another wave of price reductions will be intensified.

The industry points out that Qualcomm has always been in a leading position in the non Apple mid to high end mobile phone market, so this price reduction is focused on the mid to low end sector. It is hoped that by accelerating inventory digestion, it will welcome the launch of the new generation Snapdragon series of mobile phone chips in mid to late October.

It is understood that in the past, Qualcomm would only start a price war after the accumulation of old products for more than a year. This time, unlike in the past, prices began to be significantly reduced less than half a year after the product was launched. The main reason is that in addition to the upcoming new products, another major reason is that the consumer market downturn will continue at least until the end of the year.

As for whether MediaTek will be affected by Qualcomm's price war? The legal representative believes that MediaTek's shipment of mobile phone chips has jumped to the top in the world, and with MediaTek's new chips starting to shift to the mid to high-end market after the second quarter of this year, the impact is expected to be less severe than in the past. In other words, MediaTek still has the opportunity to meet its original financial forecast this quarter, with revenue increasing by 4% to 11%, reaching NT $102.1 billion to NT $108.9 billion.

According to legal analysis, the sluggish trend of the consumer market may continue until the fourth quarter of this year, and there is a chance for a comprehensive improvement next year. The operating performance of MediaTek and Qualcomm this year is almost certain to be significantly lower than last year's historical high level, and it is expected to rebound as soon as 2024.