Significant localization advantages, the market share of AMOLED DDIC in Chinese Mainland has increased to 8%

With the rapid development of global display technology, the OLED display driver chip (DDIC) market is experiencing a new round of demand growth. Especially in the field of smart phones, the demand of AMOLED DDIC market is expected to reach a new high in 2024, among which the performance of manufacturers in Chinese Mainland is particularly impressive.According to Omdia's latest report, it is expected that the demand for AMOLED smartphone DDICs will increase by 27% year-on-year in 2024, reaching 889 million units. This growth is mainly due to the significant increase in the penetration rate of OLED in the smartphone display panel market, which is expected to surpass TFT LCD and reach 56% by 2024.

The technological progress and capacity expansion of panel manufacturers in Chinese Mainland are the key factors driving this growth. With the rationalization of flexible OLED panel prices and continuous improvement in yield and cost, more and more mainland brands and OEM manufacturers are upgrading LTPS LCD smartphone panels to AMOLED panels. This shift has led to higher than expected growth in AMOLED smartphone display panel shipments in the first half of 2024.

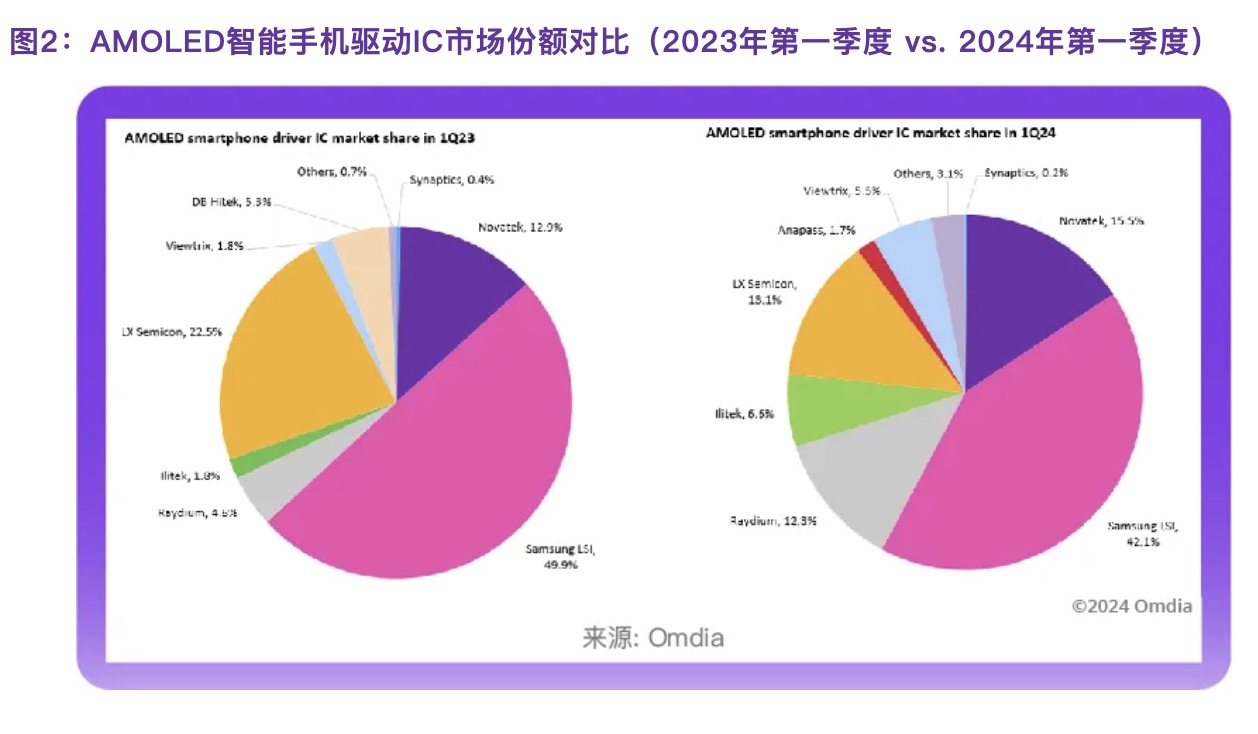

In terms of design companies, although Korean design companies still occupy the leading position in the AMOLED smartphone DDIC market, the market share of design companies in Taiwan, China and Chinese Mainland is growing rapidly. Samsung LSI and LX Semicon, as the leading Korean design companies, have seen their market share decline from 90% in the first quarter of 2019 to 57% in the first quarter of 2024. At the same time, Novatech and Ruiding, as the main suppliers of OLED smart phone panel manufacturers in Chinese Mainland, accounted for 15% and 12% of the market respectively in the first quarter of 2024.

Novatech is particularly noteworthy as it began supplying AMOLED smartphone DDIC for the iPhone 16 series to LG Display in the first quarter of 2024, and its market share is expected to further increase. In addition, Yili benefited from its outstanding performance in OPPO and other Chinese Mainland brands, and its market share increased from 1.8% in the first quarter of 2023 to 6.6% in the first quarter of 2024.

The market share of AMOLED smart phone DDIC design companies in Chinese Mainland is also gradually increasing, led by Yunyinggu, Haisi, Yisiwei and Jichuang North. Yunyinggu's market share will increase to 5.5% in the first quarter of 2024. Haisi, Yisiwei, and Jichuang North have successfully entered the brand supply chain and will continue to increase their market share in 2024. The share of design companies in Chinese Mainland in the AMOLED smart phone DDIC market rose from 2% in the first quarter of 2023 to 8% in the first quarter of 2024. The localization advantage will help mainland design companies continuously increase their market share.

Overall, the growth of the OLED DDIC market not only indicates the future trend of display technology, but also provides enormous development opportunities for companies in the global supply chain. With the continuous advancement of technology and the expansion of market demand, it is expected that the OLED DDIC market will continue to maintain strong growth momentum.

Novatech is particularly noteworthy as it began supplying AMOLED smartphone DDIC for the iPhone 16 series to LG Display in the first quarter of 2024, and its market share is expected to further increase. In addition, Yili benefited from its outstanding performance in OPPO and other Chinese Mainland brands, and its market share increased from 1.8% in the first quarter of 2023 to 6.6% in the first quarter of 2024.

The market share of AMOLED smart phone DDIC design companies in Chinese Mainland is also gradually increasing, led by Yunyinggu, Haisi, Yisiwei and Jichuang North. Yunyinggu's market share will increase to 5.5% in the first quarter of 2024. Haisi, Yisiwei, and Jichuang North have successfully entered the brand supply chain and will continue to increase their market share in 2024. The share of design companies in Chinese Mainland in the AMOLED smart phone DDIC market rose from 2% in the first quarter of 2023 to 8% in the first quarter of 2024. The localization advantage will help mainland design companies continuously increase their market share.

Overall, the growth of the OLED DDIC market not only indicates the future trend of display technology, but also provides enormous development opportunities for companies in the global supply chain. With the continuous advancement of technology and the expansion of market demand, it is expected that the OLED DDIC market will continue to maintain strong growth momentum.