SEMI: Global IDM and wafer foundry utilization rate below 80%

On November 1st, SEMI (International Semiconductor Industry Association) released North American semiconductor equipment sales data for September 2023, indicating that both front-end wafer devices and back-end packaging testing devices were not ideal. The report shows that in September, the sales of semiconductor equipment in North America reached 3.34 billion US dollars, an increase of 3% month on month and a decrease of 18% year-on-year; The sales revenue of the later stage testing equipment was 243 million US dollars, a decrease of 2% month on month and 25% year-on-year.

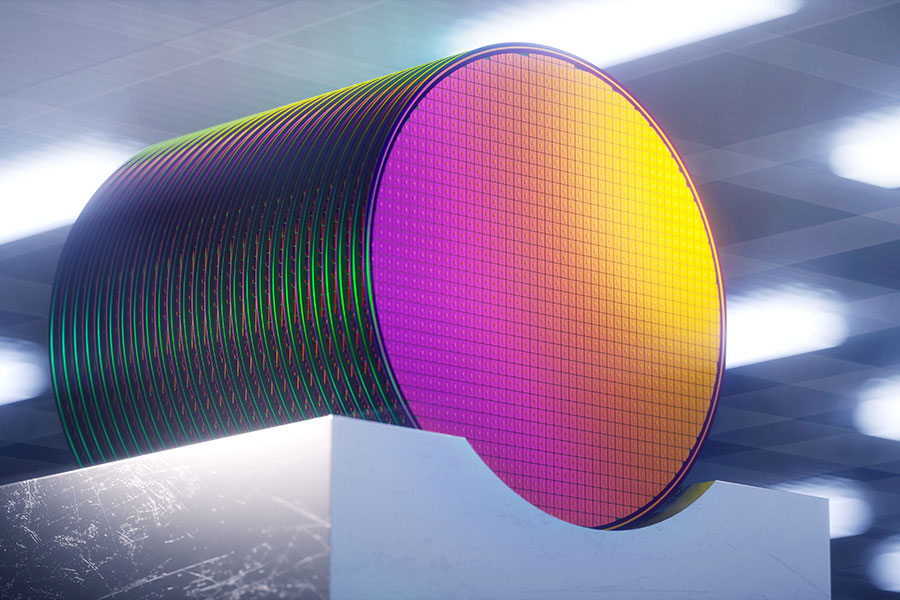

SEMI data shows that semiconductor equipment orders in North America are sluggish, and the capacity utilization rate of global IDM and wafer foundry in Q3 2023 has dropped to below 80%. It is expected to bottom out in the fourth quarter, but the total investment in the IC industry continues to grow in the third quarter of 2023. Except for CoWoS beta testing, 2/3nm, and HBM continuing to invest, all other orders have been suspended. SEMI predicts that the total investment in non storage chips will decrease in the second half of 2023

In addition, WSTS/SIA's global semiconductor revenue for August and the annual decline in the US purchasing managers' index for September have both improved month by month. Previously, these companies had too much inventory built up, so it is important to see inventory digestion first, and then take a few steps before increasing capital expenditure. No wonder North American semiconductor equipment orders have been sluggish.

In addition, WSTS/SIA's global semiconductor revenue for August and the annual decline in the US purchasing managers' index for September have both improved month by month. Previously, these companies had too much inventory built up, so it is important to see inventory digestion first, and then take a few steps before increasing capital expenditure. No wonder North American semiconductor equipment orders have been sluggish.