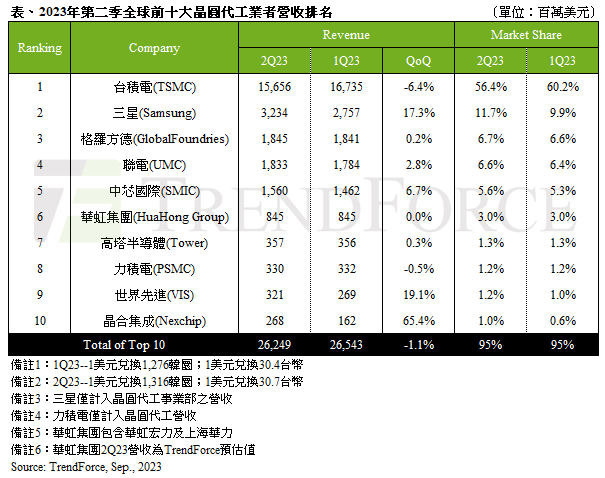

Q2 Ranking of the world's top ten foundry manufacturers: Chinese Mainland occupies three seats

Research firm TrendForce pointed out in its latest report that the production value of the world's top ten wafer foundries continued to decline in the second quarter, with a quarterly decrease of approximately 1.1%, reaching $26.2 billion.

Regarding the reasons for the decline, TrendForce stated that the inventory of some TV components has bottomed out, coupled with the booming mobile phone repair market driving TDDI demand, sporadic urgent orders appeared in the supply chain in the second quarter, becoming the main driving force for supporting the utilization of wafer foundry capacity and revenue in the second quarter. However, the benefits of this wave of urgent orders should not continue until the third quarter. On the other hand, the demand for mainstream consumer products such as smartphones, PCs, and laptops remains weak, leading to a sustained downturn in the utilization of high priced advanced manufacturing capacity. At the same time, previously relatively stable demand for automobiles, industrial control, servers, and other products has entered the inventory correction cycle.

From the perspective of manufacturer rankings, TSMC ranked first with a revenue of 15.66 billion US dollars, a quarterly decrease of 6.4%. Observing changes in advanced processes below 7nm (including), revenue from the 7/6nm process increased, but revenue from the 5/4nm process declined. Samsung ranked second with a revenue of 3.23 billion US dollars, a quarterly increase of 17.3%. Gexin ranks third, with revenue in the second quarter roughly unchanged from the first quarter, with a quarterly increase of only 0.2%, approximately $1.85 billion, with revenue growth in the smartphone and automotive sectors; Netcom has reduced its usage.

In terms of manufacturers in Chinese Mainland, SMIC ranked fifth with a revenue of 1.56 billion US dollars, with a quarterly increase of 6.7%. The overall capacity utilization rate rebounded from the first quarter, but the eight inch revenue continued to weaken; Twelve inches showed a seasonal increase of about 9%, indicating that the domestic substitution effect mainly comes from Driver IC (AMOLED DDI, TDDI), NOR Flash, MCU, etc., effectively supporting revenue growth. Huahong Group ranks sixth with a revenue of 845 million US dollars; The second quarter revenue of Hefei Jinghe Integration increased by 65.4% to 268 million US dollars, once again surpassing DB Hitek and returning to tenth place. Among them, it was mainly benefited by inventory replenishment urgent orders such as LDDI and TDDI, as well as the successful shipment of 55nm higher priced process production capacity, which led to the recovery of the utilization rate of the second quarter production capacity of the integrated circuit to 60-65% and contributed to rapid revenue growth.

In terms of manufacturers in Chinese Mainland, SMIC ranked fifth with a revenue of 1.56 billion US dollars, with a quarterly increase of 6.7%. The overall capacity utilization rate rebounded from the first quarter, but the eight inch revenue continued to weaken; Twelve inches showed a seasonal increase of about 9%, indicating that the domestic substitution effect mainly comes from Driver IC (AMOLED DDI, TDDI), NOR Flash, MCU, etc., effectively supporting revenue growth. Huahong Group ranks sixth with a revenue of 845 million US dollars; The second quarter revenue of Hefei Jinghe Integration increased by 65.4% to 268 million US dollars, once again surpassing DB Hitek and returning to tenth place. Among them, it was mainly benefited by inventory replenishment urgent orders such as LDDI and TDDI, as well as the successful shipment of 55nm higher priced process production capacity, which led to the recovery of the utilization rate of the second quarter production capacity of the integrated circuit to 60-65% and contributed to rapid revenue growth.