Institution: Q2 Global smartphone production reached a 10-year low of 270 million units, with Transsion ranking among the top five

Research firm TrendForce released a report on September 4th that, following a nearly 20% year-on-year decrease in global smartphone production in the first quarter of 2023, production continued to decline by about 6.6% in the second quarter, with only 270 million units. The total smartphone production in the first half of 2023 was 520 million units, a 13.3% decline compared to the same period last year.

The institution stated that both individual quarters and the total of the first half of the year have set a 10-year record low. There are three reasons for the sluggish production performance. Firstly, the lifting of epidemic prevention restrictions did not drive demand as expected; Secondly, the demographic dividend effect in the emerging Indian market has not effectively utilized its advantages; Thirdly, in 2022, brands were heavily affected by excessive channel inventory. Initially, it was estimated that with inventory depletion, the brand would resume production levels. However, due to the impact of economic weakness, people's consumption willingness is more conservative, resulting in lower than expected production performance in the first half of the year.

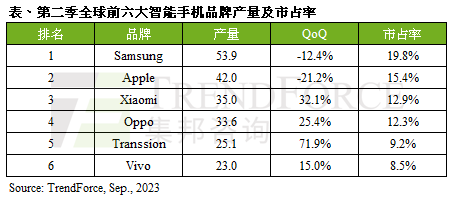

By brand, Samsung, Apple, Xiaomi, OPPO, Chuanyin, and vivo are among the top six. Chuanyin squeezed out Vivo and entered fifth place globally for the first time. Its production increased by as much as 70% month on month, reaching 25.1 million units in Q2. Institutional analysis shows that the reason for the high yield of Chuanyin is due to channel inventory replenishment, new product launch, and entry into the mid to high end market. Since March, there has been quite good production performance, and it is estimated that this growth trend will continue into the third quarter. Vivo (including iQOO) has a conservative view of market demand in the second half of the year, so production planning has been controlled. In the second quarter, the production volume was 23 million units, a 15% increase compared to the previous quarter, dropping to the sixth place in the world.

Samsung remains at the top, with smartphone production of 53.9 million units in the second quarter, a decrease of 12.4% compared to the previous quarter. The institution believes that although the Galaxy Z Fold5/Flip5 folding screen new machine has been released, its contribution to overall production growth is limited.

Apple had a traditional off-season in the second quarter, with a production of 42 million units, a decrease of 21.2% compared to the previous quarter. The organization stated that the upcoming new iPhone 15/15 Plus will have an impact on production performance in the third quarter due to poor CMOS yield. However, Apple still has the hope of surpassing Samsung with the iPhone 15 series and becoming the world's leading smartphone brand in terms of market share.

Xiaomi (including Xiaomi, Redmi, and POCO) benefited from the gradual decline in channel inventory and the promotion of new machine sales. Its production in the second quarter was about 35 million units, an increase of 32.1% month on month. Compared to other brands, Xiaomi's channel inventory is still relatively high. OPPO (including realme and OnePlus) benefited from the rebound in demand in Southeast Asia and other regions in the second quarter, with production of approximately 22.6 million units, an increase of 25.4% compared to the previous quarter.

TrendForce predicts that the smartphone market may experience another wave of transformation in the fourth quarter of this year due to global economic conditions, leading to a possible downward revision in production in the second half of the year. Looking ahead to 2024, the current economic situation is not optimistic, and TrendForce still maintains an estimated annual increase of 2-3% in global production. It remains to be seen whether regional economic trends will further drag down production performance.

Samsung remains at the top, with smartphone production of 53.9 million units in the second quarter, a decrease of 12.4% compared to the previous quarter. The institution believes that although the Galaxy Z Fold5/Flip5 folding screen new machine has been released, its contribution to overall production growth is limited.

Apple had a traditional off-season in the second quarter, with a production of 42 million units, a decrease of 21.2% compared to the previous quarter. The organization stated that the upcoming new iPhone 15/15 Plus will have an impact on production performance in the third quarter due to poor CMOS yield. However, Apple still has the hope of surpassing Samsung with the iPhone 15 series and becoming the world's leading smartphone brand in terms of market share.

Xiaomi (including Xiaomi, Redmi, and POCO) benefited from the gradual decline in channel inventory and the promotion of new machine sales. Its production in the second quarter was about 35 million units, an increase of 32.1% month on month. Compared to other brands, Xiaomi's channel inventory is still relatively high. OPPO (including realme and OnePlus) benefited from the rebound in demand in Southeast Asia and other regions in the second quarter, with production of approximately 22.6 million units, an increase of 25.4% compared to the previous quarter.

TrendForce predicts that the smartphone market may experience another wave of transformation in the fourth quarter of this year due to global economic conditions, leading to a possible downward revision in production in the second half of the year. Looking ahead to 2024, the current economic situation is not optimistic, and TrendForce still maintains an estimated annual increase of 2-3% in global production. It remains to be seen whether regional economic trends will further drag down production performance.