Institution: DRAM/NAND contract prices increased by approximately 18% in Q1, with a sustained upward trend throughout the year

According to a research report by TrendForce, the contract price of DRAM products has been declining since the fourth quarter of 2021, falling for 8 consecutive quarters, and rising in the fourth quarter of 2023. The NAND Flash contract price has been declining since the third quarter of 2022, falling for four consecutive quarters, and rising since the third quarter of 2023. It is expected that the prices of these two types of storage chips will increase significantly by about 18% in the first quarter of 2024, and the increase will converge in the second quarter.

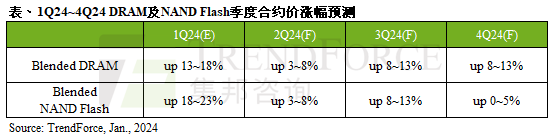

TrendForce maintains its previous forecast, with DRAM contract prices increasing by approximately 13-18% quarterly; NAND Flash is 18-23%. Although the current market view on overall demand for the second quarter is conservative, storage chip suppliers have raised their DRAM capacity utilization rates in the late fourth quarter of 2023 and NAND Flash capacity utilization rates in the first quarter of 2024.

The institution expects that the month on month increase in DRAM and NAND Flash contract prices will converge to 3-8% in the second quarter. After entering the traditional peak season in the third quarter, the demand side expects North American cloud service providers (CSPs) to have strong replenishment momentum, and there is a chance for the quarterly increase in contract prices of two types of storage chips to expand to 8-13%. Among them, DRAM benefits from the increase in penetration rates of DDR5 and HBM, leading to an increase in average unit price and expanding the overall DRAM market growth.

It is expected that the upward trend of storage chips will continue in the fourth quarter of 2024, with DRAM increasing by 8-13% and NAND Flash increasing by 0-5%. However, single products such as DDR5 may experience a price drop.

It is expected that the upward trend of storage chips will continue in the fourth quarter of 2024, with DRAM increasing by 8-13% and NAND Flash increasing by 0-5%. However, single products such as DDR5 may experience a price drop.