Institution announces Q4 2023 semiconductor ranking: TSMC wafer foundry holds 61% share

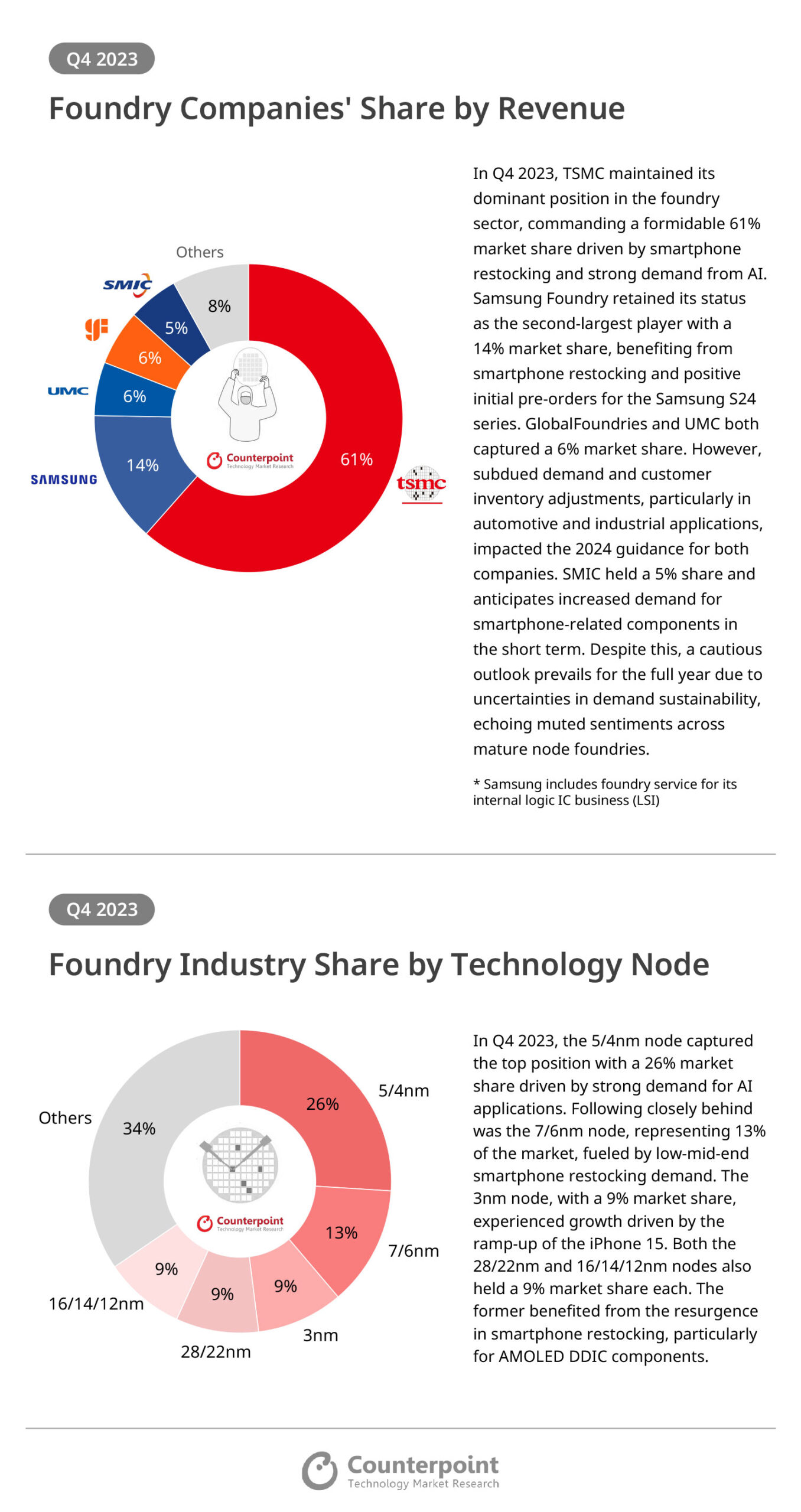

According to a report by research firm Counterpoint on March 27th, TSMC held a dominant position in the global wafer foundry market with a 61% market share in the fourth quarter of 2023; Samsung benefited from smartphone restocking and pre order launch of the Samsung Galaxy S24 series, maintaining second place with a market share of 14%.

Liandian and Gexin have a market share of about 6%, and weak demand and inventory adjustments (especially in the automotive and industrial sectors) have affected these two companies, leading to conservative expectations for their 2024 targets; SMIC ranks fifth with a 5% share, and it is expected that the demand for smartphone related components will increase in the short term.

Divided by process nodes, in the fourth quarter of 2023, driven by the demand for artificial intelligence (AI), 5nm/4nm nodes accounted for 26% of the market share, with the largest proportion; The 7nm/6nm process accounts for 13% and ranks second, mainly due to entry-level smartphone chips; The current most advanced 3nm nodes account for 9% of the market share, and the demand mainly comes from the A17 Pro chip installed on the iPhone 15 Pro/Max; In other process areas, the 28nm/22nm and 16nm/14nm/12nm processes account for approximately 9% of the market share, with the former mainly benefiting from the growing demand for AMOLED DDIC display driver chips driven by smartphones.

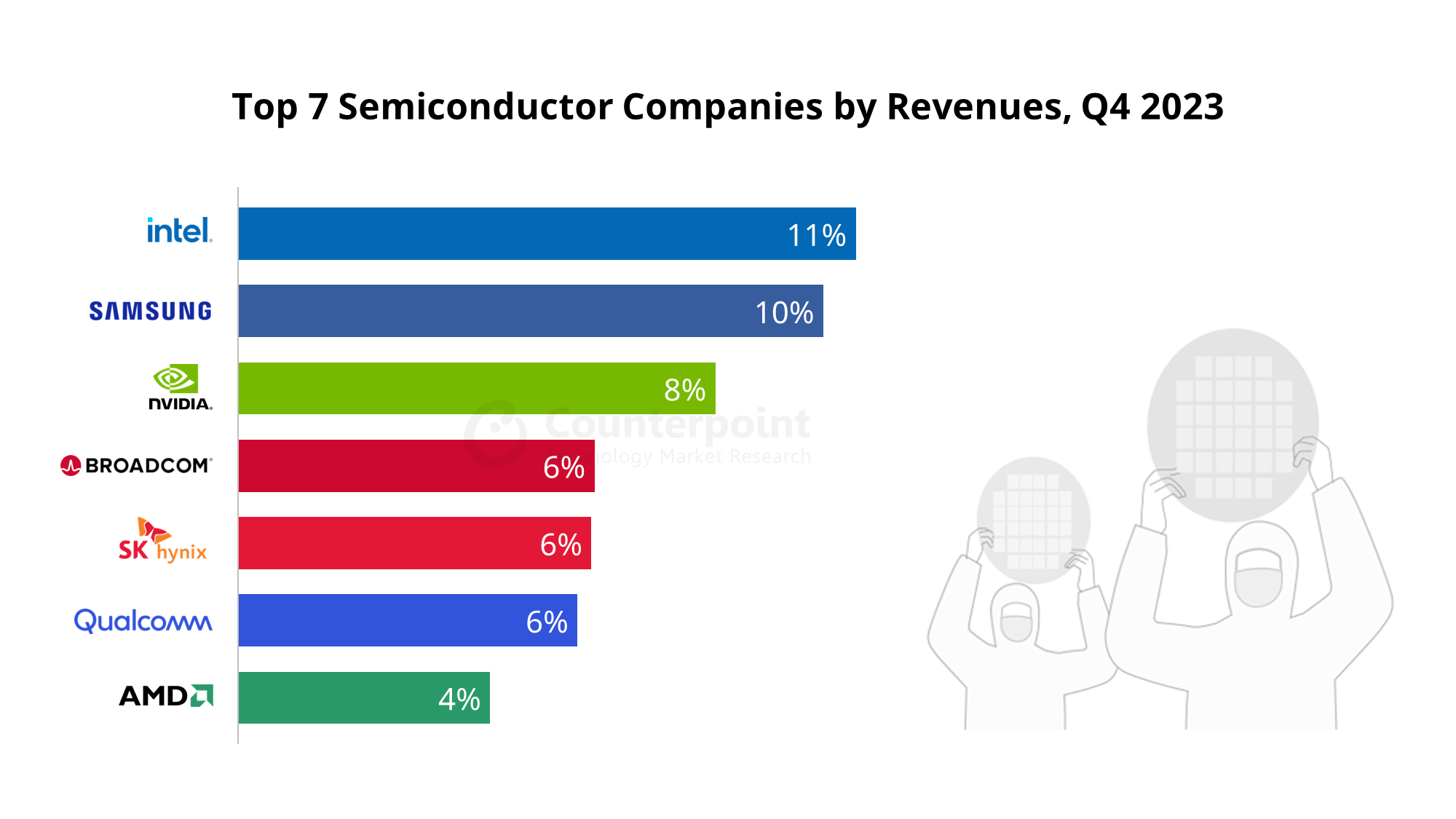

Counterpoint also released a global chip company revenue ranking for the fourth quarter of 2023, with Intel, Samsung, and Nvidia ranking in the top three; Intel's market share reached 11%, mainly due to the normalization of its consumer computing business unit, which achieved a quarterly growth of 12%; Botong ranks fourth, benefiting from strong demand from large enterprises for artificial intelligence data centers; SK Hynix has benefited from the recovery of storage chips, with continuous revenue growth this quarter; Qualcomm and AMD also achieved quarterly revenue growth, ranking sixth and seventh respectively.