IDC: Semiconductor sales will rebound by 20% next year, with double-digit growth in OEM packaging

According to the latest research by IDC (International Data Information), the global semiconductor sales market is expected to decrease by 12% annually in 2023. However, in 2024, the semiconductor industry will experience explosive growth in global AI and HPC, driven by the rebound in demand for NB, PC, mobile phones, servers, and automobiles. IDC's senior research manager, Zeng Guanwei, predicts that the semiconductor industry will usher in a new round of growth in 2024.IDC expects that the semiconductor sales market will return to a growth trend in 2024, with an annual growth rate of 20%.

Zeng Guanwei pointed out that due to weak terminal demand, the process of destocking in the supply chain continues. Although sporadic short and urgent orders have been seen in the second half of 2023, it is still difficult to reverse the performance of a 20% annual decline in the first half of 2023. It is expected that the semiconductor sales market will decrease by 12% annually in 2023.

However, in 2024, after experiencing nearly 40% market decline in memory, the production reduction effect will ferment and drive up product prices, coupled with the increased penetration rate of high priced HBMs, which is expected to become a driving force for market growth. With the gradual recovery of terminal demand and the shortage of AI chips, IDC expects the semiconductor sales market to return to a growth trend in 2024, with an annual growth rate of 20%.

In terms of IC design industry, IDC believes that in addition to continuous deepening, smartphone applications are entering AI and automotive applications to adapt to the rapidly changing market environment. With the gradual recovery of the global personal device market, there will be new growth opportunities, and it is expected that the overall market growth will reach 14% annually in 2024.

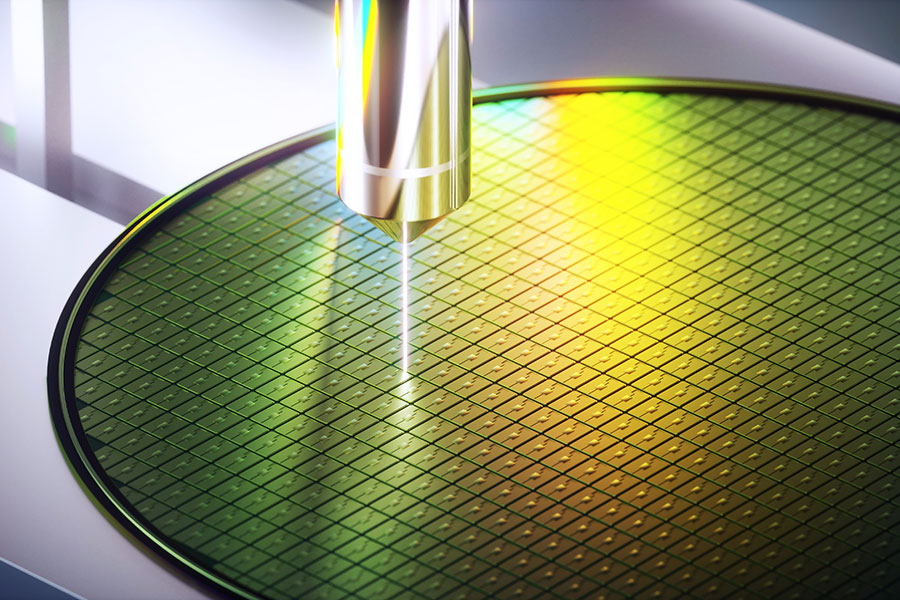

The wafer foundry industry is affected by market inventory adjustments, resulting in a significant decline in capacity utilization in 2023. However, driven by the rebound in demand for some consumer electronics and the explosive demand for AI, 12 inch wafer factories have slowly recovered in the second half of 2023, especially with the most obvious recovery in advanced processes. Looking ahead to 2024, with TSMC leading the way, Samsung and Intel continuing to develop, and terminal demand gradually stabilizing, the market will continue to rise. It is expected that the global semiconductor wafer foundry industry will experience double-digit growth in 2024.

In addition, IDC also predicts that the 2.5/3D packaging market will have a compound annual growth rate of 22% from 2023 to 2028, which will be a highly anticipated area in the semiconductor packaging testing market in the future.

However, in 2024, after experiencing nearly 40% market decline in memory, the production reduction effect will ferment and drive up product prices, coupled with the increased penetration rate of high priced HBMs, which is expected to become a driving force for market growth. With the gradual recovery of terminal demand and the shortage of AI chips, IDC expects the semiconductor sales market to return to a growth trend in 2024, with an annual growth rate of 20%.

In terms of IC design industry, IDC believes that in addition to continuous deepening, smartphone applications are entering AI and automotive applications to adapt to the rapidly changing market environment. With the gradual recovery of the global personal device market, there will be new growth opportunities, and it is expected that the overall market growth will reach 14% annually in 2024.

The wafer foundry industry is affected by market inventory adjustments, resulting in a significant decline in capacity utilization in 2023. However, driven by the rebound in demand for some consumer electronics and the explosive demand for AI, 12 inch wafer factories have slowly recovered in the second half of 2023, especially with the most obvious recovery in advanced processes. Looking ahead to 2024, with TSMC leading the way, Samsung and Intel continuing to develop, and terminal demand gradually stabilizing, the market will continue to rise. It is expected that the global semiconductor wafer foundry industry will experience double-digit growth in 2024.

In addition, IDC also predicts that the 2.5/3D packaging market will have a compound annual growth rate of 22% from 2023 to 2028, which will be a highly anticipated area in the semiconductor packaging testing market in the future.