ASE Investment Holdings achieved a revenue of NT $47.5 billion in May, marking the second highest increase in the same period in both month and month

On June 11th, global testing leader ASE Investment Holdings announced that its revenue for May was NT $47.493 billion, a monthly increase of 3.65% and an annual increase of 2.71%. The cumulative revenue for the first five months was NT $226.16 billion, an annual increase of 2.57%; Benefiting from the slow recovery of customer demand, ASE Investment Control's May revenue reached a new high since the beginning of this year, also rewriting the second highest in the same period.

ASE Investment Control's packaging testing and material revenue in May was 26.568 billion yuan, a monthly increase of 5.5% and an annual increase of 1.3%.

Looking ahead to the second half of the year, ASE Investment Control is optimistic that all applications will recover from the bottom, especially in the AI and HPC fields, which will continue to grow strongly and have a higher growth rate than other applications. From a business perspective, we are optimistic about the performance of our testing business this year. We expect the yield rate to increase to over 60% in the second quarter, and it will further rebound in the second half of the year, driving the gross profit margin of our testing business back to the 24% -30% range.

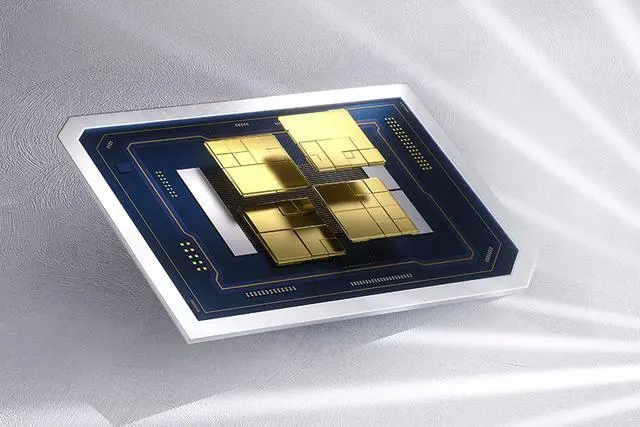

ASE Investment Control has recently received numerous advanced packaging cases, and is optimistic that this year's performance in advanced packaging will double compared to last year. There will also be good growth momentum next year. In addition to cooperating with wafer factories, it has also begun to jointly develop with IC design manufacturers and system factories, injecting long-term growth momentum.

In addition, ASE Investment&Control has recently joined hands with AMD and China System Integration to jointly build AMD's first water-cooled server room in Taiwan, China, China, to improve energy efficiency through the excellent cooling efficiency of advanced water-cooled cooling technology, to assist ASE Kaohsiung plant in its intelligent transformation, and to achieve the goal of green computing, energy conservation and carbon reduction.

Looking ahead to the second half of the year, ASE Investment Control is optimistic that all applications will recover from the bottom, especially in the AI and HPC fields, which will continue to grow strongly and have a higher growth rate than other applications. From a business perspective, we are optimistic about the performance of our testing business this year. We expect the yield rate to increase to over 60% in the second quarter, and it will further rebound in the second half of the year, driving the gross profit margin of our testing business back to the 24% -30% range.

ASE Investment Control has recently received numerous advanced packaging cases, and is optimistic that this year's performance in advanced packaging will double compared to last year. There will also be good growth momentum next year. In addition to cooperating with wafer factories, it has also begun to jointly develop with IC design manufacturers and system factories, injecting long-term growth momentum.

In addition, ASE Investment&Control has recently joined hands with AMD and China System Integration to jointly build AMD's first water-cooled server room in Taiwan, China, China, to improve energy efficiency through the excellent cooling efficiency of advanced water-cooled cooling technology, to assist ASE Kaohsiung plant in its intelligent transformation, and to achieve the goal of green computing, energy conservation and carbon reduction.