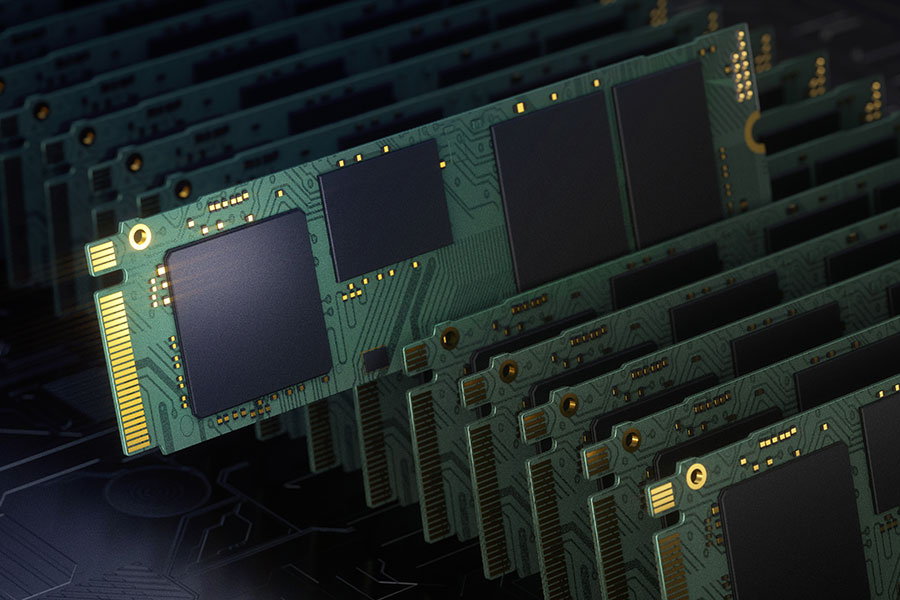

A large number of Chinese storage modules are experiencing a wave of selling, leading to a decline in SSD prices

Due to the continued weak consumer demand and China's increased review efforts, Chinese storage module manufacturers are accelerating the clearance of excess inventory after clearing it in the second quarter of 2024. Recently, there has been a large wave of selling, leading to a decline in spot prices in the solid-state drive (SSD) market.

Despite the high prices of NAND wafers, the finished product prices in the spot market have fallen back to the level of early 2023. Industry experts predict that the turbulence in the Chinese market will continue until the end of the year, and there may be temporary shortages of certain special products.

Industry insiders point out that in the past two years, China has actively promoted the construction of domestic supply chains. Many local storage module manufacturers have taken this opportunity to win government contracts and local brand orders, leading to rapid business growth and a wave of emerging start-up companies eager for financing. However, many storage providers are subject to tax audits in 2024, and there are signs of panic and anxiety in the Chinese storage market. In April of this year, the General Administration of Customs organized the first round of centralized crackdown on smuggling in the construction of the Service Guarantee Free Trade Pilot Zone, mainly targeting illegal and criminal activities such as issuing false value-added tax invoices, defrauding subsidies, defrauding export tax refunds, and money laundering. It cracked down on smuggling using the convenience policies of the Free Trade Pilot Zone and the Customs Special Supervision Zone, involving multiple domestic storage manufacturers, and had a profound impact on the entire industry.

Chinese storage module manufacturers have sold off a large amount of low-cost inventory in preparation for the expected market cooling in the second quarter of 2024. They had expected a recovery in the second half of 2024, but it did not materialize. The continued weak demand in the terminal market in September has exacerbated the downward trend in prices, causing the industry to face difficulties and forcing some companies to sell their final reserves.

In addition to weak demand in the Chinese market, overseas markets such as Europe, Southeast Asia, and South America are also facing unexpected demand. Chinese industry insiders pointed out that although they have prepared for the off-season, they did not anticipate such a significant decline, with performance only about half of the same period in 2023.

According to the latest data from market research firm Omdia, the price of the top selling three-layer unit (TLC) 256Gb NAND flash memory product in the third quarter is expected to decrease by 2.6% from $1.54 in the previous quarter to $1.5. This trend reflects broader market dynamics, namely that demand in major industries such as smartphones and PCs has not yet recovered, thereby affecting the rebound in prices.

However, there has not been a consistent decline in the market. Omdia predicts that the price of quad layer unit (QLC) NAND 256Gb used in enterprise solid state drives (SSDs) is expected to rise from $1.23 in Q2 to $1.36 in Q4.

The polarization of the NAND market, where prices of consumer oriented products decline while prices of server oriented products rise, is a noteworthy development trend. Omdia also lowered its forecast for the penetration rate of AI PCs in the PC market this year from 11% to below 10%, citing Intel's restructuring impact as one of the reasons.

Industry insiders point out that in the past two years, China has actively promoted the construction of domestic supply chains. Many local storage module manufacturers have taken this opportunity to win government contracts and local brand orders, leading to rapid business growth and a wave of emerging start-up companies eager for financing. However, many storage providers are subject to tax audits in 2024, and there are signs of panic and anxiety in the Chinese storage market. In April of this year, the General Administration of Customs organized the first round of centralized crackdown on smuggling in the construction of the Service Guarantee Free Trade Pilot Zone, mainly targeting illegal and criminal activities such as issuing false value-added tax invoices, defrauding subsidies, defrauding export tax refunds, and money laundering. It cracked down on smuggling using the convenience policies of the Free Trade Pilot Zone and the Customs Special Supervision Zone, involving multiple domestic storage manufacturers, and had a profound impact on the entire industry.

Chinese storage module manufacturers have sold off a large amount of low-cost inventory in preparation for the expected market cooling in the second quarter of 2024. They had expected a recovery in the second half of 2024, but it did not materialize. The continued weak demand in the terminal market in September has exacerbated the downward trend in prices, causing the industry to face difficulties and forcing some companies to sell their final reserves.

In addition to weak demand in the Chinese market, overseas markets such as Europe, Southeast Asia, and South America are also facing unexpected demand. Chinese industry insiders pointed out that although they have prepared for the off-season, they did not anticipate such a significant decline, with performance only about half of the same period in 2023.

According to the latest data from market research firm Omdia, the price of the top selling three-layer unit (TLC) 256Gb NAND flash memory product in the third quarter is expected to decrease by 2.6% from $1.54 in the previous quarter to $1.5. This trend reflects broader market dynamics, namely that demand in major industries such as smartphones and PCs has not yet recovered, thereby affecting the rebound in prices.

However, there has not been a consistent decline in the market. Omdia predicts that the price of quad layer unit (QLC) NAND 256Gb used in enterprise solid state drives (SSDs) is expected to rise from $1.23 in Q2 to $1.36 in Q4.

The polarization of the NAND market, where prices of consumer oriented products decline while prices of server oriented products rise, is a noteworthy development trend. Omdia also lowered its forecast for the penetration rate of AI PCs in the PC market this year from 11% to below 10%, citing Intel's restructuring impact as one of the reasons.